Introduction

Wealth is not just about having money but about how one approaches it. Over time, various studies and observations show that wealthy individuals have distinct habits that contribute to their financial success. While these habits may seem subtle, they play a significant role in building and maintaining wealth. This article will explore some of the key differences in how the wealthy manage their finances compared to those who are not as financially successful.

Related Article

1. Stealth Wealth: The Wealthy Keep a Low Profile

One of the most common misconceptions is that rich people flaunt their wealth. However, true wealth is often characterized by subtlety. The rich do not typically showcase their money through flashy cars, designer clothes, or extravagant social media posts. Instead, wealth is seen as freedom—freedom from the need to impress others and the autonomy to live life on their own terms.

On social media, it can be difficult to distinguish between those who genuinely have wealth and those who are merely portraying it. Influencers may rent luxury cars or buy expensive items to project an image of success. In reality, many of these influencers do not possess the financial stability they claim to have. Wealthy individuals understand that revealing their financial status has few advantages, and they avoid drawing unnecessary attention to themselves.

By keeping a low profile, the rich minimize risks such as theft and robbery while focusing on things that bring them long-term satisfaction, rather than constantly chasing the latest trends or status symbols.

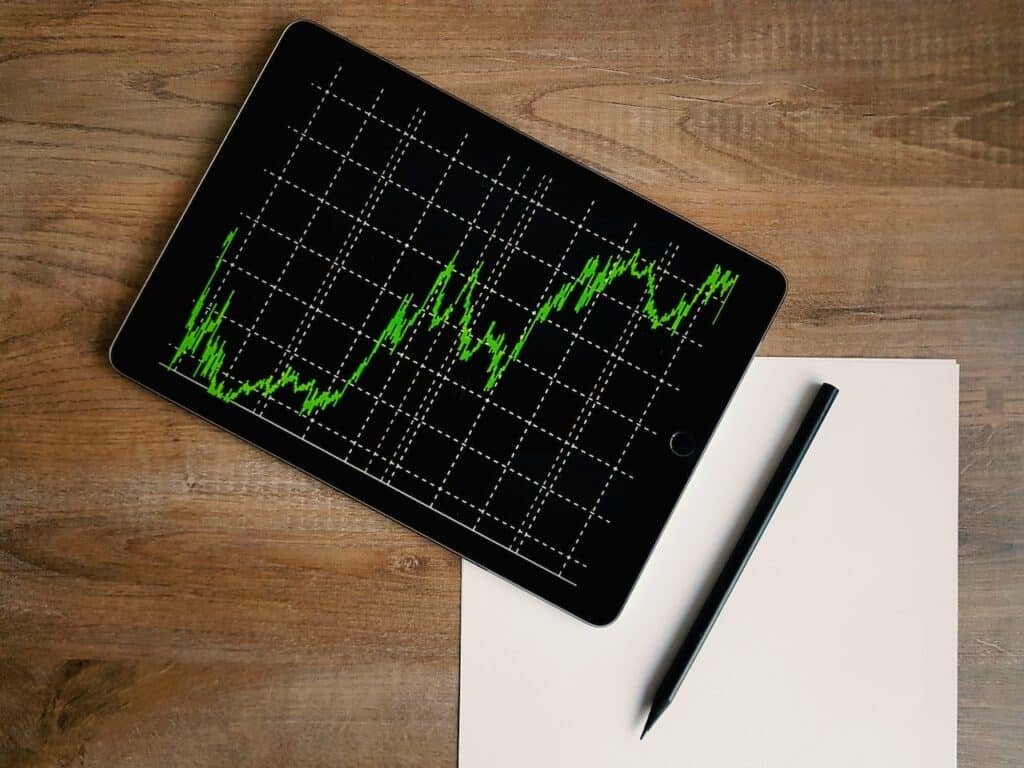

2. Wealthy People Invest Rather Than Spend

One of the key principles that wealthy people understand is that it takes money to make money. Instead of spending every dollar as it comes in, they save and invest. Wealthy individuals recognize the power of compounding and know that capital scales effectively.

For instance, investing $100 in an index fund that tracks the market with a 10% return will yield $10. However, investing $100,000 in the same fund would result in a $10,000 return. The wealthy focus on growing their capital, understanding that larger investments yield proportionally greater returns. This mindset of saving and investing early on helps the rich accumulate wealth more rapidly.

The wealthy also know that building a substantial nest egg helps cushion them from financial setbacks. For example, a $5,000 emergency can be devastating to someone with a $10,000 net worth, but for someone with a $500,000 net worth, it only represents a small fraction of their wealth.

3. The Power of Delayed Gratification

Wealthy people understand the importance of delaying gratification. Rather than spending impulsively, they resist the temptation for immediate rewards in favor of much bigger payoffs later in life. For example, skipping small daily purchases and investing the money instead can lead to significantly greater wealth in the long term.

According to the Money Guy Show, $1 invested at the age of 20 can be worth $88 by the time the individual reaches 65, assuming a 10% return. Even with a more conservative 8% return, $1 can grow to over $30. Wealthy individuals understand this compounding effect and are willing to sacrifice short-term pleasures for long-term gains.

Stretching one’s time horizon when making decisions can also lead to better outcomes. For instance, when faced with a career decision, considering where one wants to be in 10, 20, or 30 years can provide clarity, helping to prioritize long-term goals over short-term benefits.

4. Investing in Assets

The rich know the importance of investing in assets. Unlike poor individuals who may keep their money in savings accounts, the wealthy actively invest in things that appreciate in value or generate income. Assets like stocks, real estate, and business interests are common among the wealthy because they provide long-term returns.

A detailed breakdown of net worth among different tiers of wealth shows that wealthier individuals tend to own assets that increase in value over time. Business interests, real estate, and equities become more significant portions of their wealth as they accumulate more capital. In contrast, lower-net-worth individuals often have a larger portion of their wealth tied up in depreciating assets like vehicles.

Understanding the difference between appreciating and depreciating assets is key to growing wealth. Wealthy individuals aim to acquire assets that will increase in value or provide cash flow over time.

Related Article

5. Mastering Money Management

Money management is a crucial skill among the wealthy. Rich people are aware of where their money is going and ensure that they are not overspending. While they may not track every dollar, they have a clear sense of their income, expenses, and savings, allowing them to manage their finances effectively.

In today’s social media-driven world, there is a constant pressure to spend. Many people feel the need to keep up with others online, leading to overspending. According to a Credit Karma survey, 38% of Gen Z and 28% of Millennials have admitted to spending money on travel after seeing other people’s vacations on social media. Wealthy individuals, however, prioritize saving and investing over keeping up with appearances.

A good rule of thumb for managing money is the 60/30/10 rule, which suggests allocating 60% of your income to needs, 30% to wants, and 10% to savings and investments. By consistently saving even a small percentage of income, individuals can build wealth over time.

6. Excellent Credit: A Key to Leveraging Wealth

Rich people understand the importance of maintaining excellent credit. Good credit allows them to leverage their wealth by accessing loans at lower interest rates. In order to build and maintain good credit, it is essential to make payments on time and avoid overextending oneself in terms of consumer debt.

A high credit score can save thousands of dollars in interest payments over time. For instance, a 0.5% difference in mortgage rates could lead to savings of over $39,000 on a $500,000 house over the course of a 30-year mortgage. The wealthy understand that maintaining a high credit score is crucial for optimizing their financial opportunities.

7. A Commitment to Lifelong Learning

One final habit that sets the wealthy apart is their dedication to lifelong learning. Whether through reading, attending seminars, or engaging with knowledgeable individuals, the wealthy continuously seek to expand their understanding of the world. This thirst for knowledge often leads to new opportunities and better decision-making.

In the pursuit of wealth, growth and education are critical. Stagnation can limit one’s financial success, whereas constantly learning opens up new pathways to wealth.

Conclusion

The habits of the wealthy offer valuable insights into how to build and sustain financial success. By focusing on stealth wealth, investing rather than spending, delaying gratification, acquiring appreciating assets, managing money effectively, maintaining excellent credit, and committing to lifelong learning, individuals can adopt the mindset necessary for long-term financial prosperity.

Author

Hi, I’m Amine! My mission is to make finance accessible and fun for everyone. I love breaking down things that seem difficult into simple, easy, and useful tips that help you make good decisions. My aim is to ensure your experience on our blog is informative and fun.

View all posts

You actually make it seem so easy with your presentation but I find this topic to be actually something which I think I would never understand. It seems too complex and extremely broad for me. I am looking forward for your next post, I will try to get the hang of it!

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get three emails with the same comment. Is there any way you can remove people from that service? Thanks a lot!

What i do not understood is in truth how you’re now not really a lot more well-preferred than you might be now. You’re very intelligent. You understand thus considerably in relation to this subject, produced me in my opinion consider it from so many numerous angles. Its like men and women don’t seem to be fascinated until it is one thing to accomplish with Lady gaga! Your individual stuffs great. Always take care of it up!

Hey there are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and create my own. Do you need any html coding knowledge to make your own blog? Any help would be greatly appreciated!

I have been absent for some time, but now I remember why I used to love this website. Thanks , I’ll try and check back more frequently. How frequently you update your web site?

I like this website because so much utile material on here : D.

Rattling good info can be found on site.

Woh I enjoy your articles, saved to bookmarks! .

I got what you intend, regards for putting up.Woh I am pleased to find this website through google.

I have not checked in here for a while since I thought it was getting boring, but the last several posts are good quality so I guess I’ll add you back to my daily bloglist. You deserve it my friend 🙂